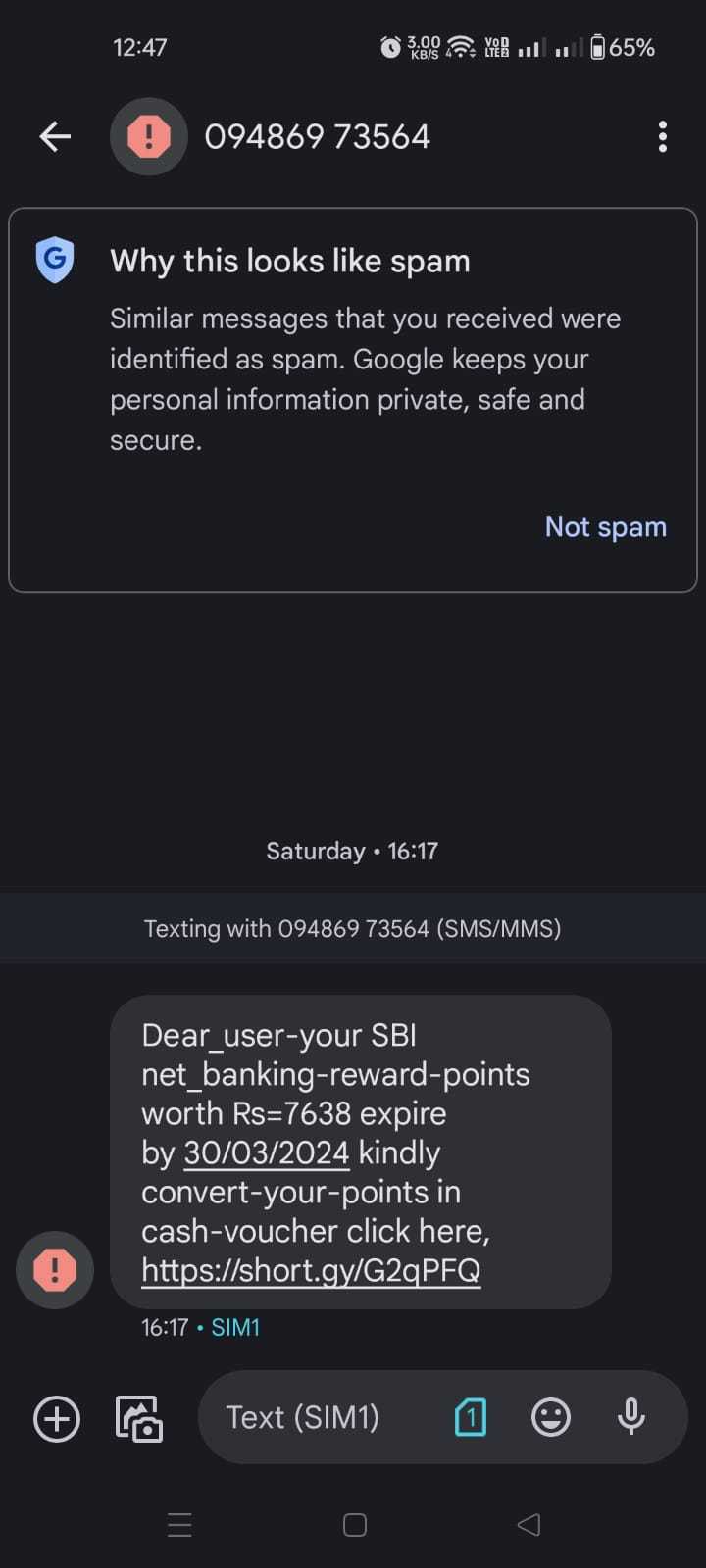

Phishing: Dear_user-your SBI net_banking-reward-points worth Rs=7638 expire by 30/03/2024

Dear_user-your SBI net_banking-reward-points worth Rs=7638 expire by 30/03/2024 kindly convert-your-points in cash-voucher click here.

Complete SMS

From: +91 94869 73564

SMS:

Dear_user-your SBI net_banking-reward-points worth Rs=7638 expire by 30/03/2024 kindly convert-your-points in cash-voucher click here, https://short.gy/G2qPFQ.

Red Flag

The SMS message received is highly suspicious and exhibits several red flags that suggest it's a phishing attempt or scam:

-

Unexpected Contact: Legitimate organizations don't typically send unsolicited messages that require immediate action.

-

Unusual Formatting: The message uses odd formatting with hyphens and underscores (e.g., "Dear_user-your SBI net_banking-reward-points..."), not common in professional communications from banks.

-

Vague and Unsolicited Offer: Offering to convert expiring reward points into cash vouchers without prior notification is a tactic often used in scams.

-

Shortened and Obscure Link: The inclusion of a shortened URL (

https://short.gy/G2qPFQ) hides the actual destination, a technique frequently used in phishing to lead recipients to malicious sites. -

Urgency to Act: Creating a sense of urgency by mentioning a specific expiration date is a tactic designed to prompt hasty actions without proper verification.

-

Generic Call to Action: Asking to click on a link for an action is typical of phishing attempts aimed at stealing personal information.

-

Lack of Personalization: Addressing the recipient generically instead of by name is common in broad phishing schemes.

-

Inappropriate Sender ID: Crucially, SBI (State Bank of India) never sends SMS from personal mobile numbers. Official communications come from identifiable sender IDs that reflect the bank's name or from designated official numbers, not from standard mobile numbers like the one provided (+91 94869 73564).

Given these concerns, it's advisable not to click on any links and to verify any doubts directly with your bank through their official customer service channels.