Fraud: LOAN / INVESTMENT OFFER ( from US$ 10 Million to US$ 10 Billion for your project)

LOAN / INVESTMENT OFFER ( from US$ 10 Million to US$ 10 Billion for your project) | Leonard Bernstein Global Investment Scam

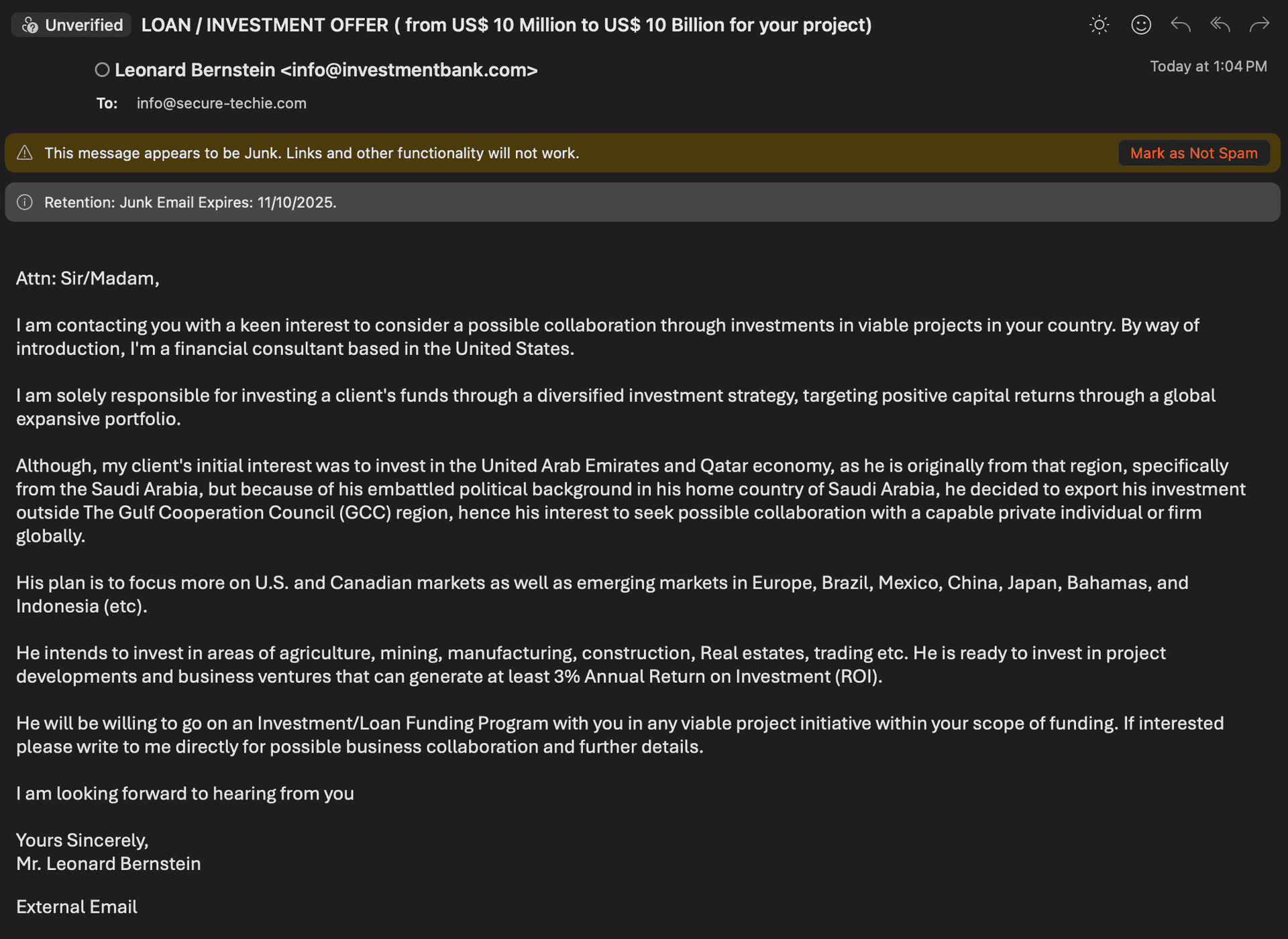

Complete Email

From: Leonard Bernstein <info@investmentbank.com>

Subject: LOAN / INVESTMENT OFFER ( from US$ 10 Million to US$ 10 Billion for your project)

Email Body

Attn: Sir/Madam,

I am contacting you with a keen interest to consider a possible collaboration through investments in viable projects in your country. By way of introduction, I'm a financial consultant based in the United States.

I am solely responsible for investing a client's funds through a diversified investment strategy, targeting positive capital returns through a global expansive portfolio.

Although, my client's initial interest was to invest in the United Arab Emirates and Qatar economy, as he is originally from that region, specifically from the Saudi Arabia, but because of his embattled political background in his home country of Saudi Arabia, he decided to export his investment outside The Gulf Cooperation Council (GCC) region, hence his interest to seek possible collaboration with a capable private individual or firm globally.

His plan is to focus more on U.S. and Canadian markets as well as emerging markets in Europe, Brazil, Mexico, China, Japan, Bahamas, and Indonesia (etc).

He intends to invest in areas of agriculture, mining, manufacturing, construction, Real estates, trading etc. He is ready to invest in project developments and business ventures that can generate at least 3% Annual Return on Investment (ROI).

He will be willing to go on an Investment/Loan Funding Program with you in any viable project initiative within your scope of funding. If interested please write to me directly for possible business collaboration and further details.

I am looking forward to hearing from you

Yours Sincerely,

Mr. Leonard Bernstein

Red Flags

This message is a textbook example of a large-capital advance-fee / investment facilitation scam. It mixes wealth-flight narrative, generic institution branding, unrealistic capital access, and a deliberately low sophistication threshold (only 3% ROI) to lure targets into prolonged engagement that leads to staged fee extraction or money laundering risk.

1. Generic & Unverifiable Sender Identity

- Email Address:

info@investmentbank.comuses a highly generic domain. Reputable global investment banks use distinctive, trademarked domains; a plain descriptive domain is suspicious (often parked or newly registered). - No Regulatory Disclosures: Missing SEC / FINRA / FCA style disclaimers, CRD numbers, IARD references, Form ADV, or jurisdictional licensing statements that are standard in legitimate outbound institutional communication.

- No Physical Coordinates: No office address, phone, encrypted channel, or professional signature block.

2. Unrealistic Funding Range

- Claims access to US$10 Million to US$10 Billion — a span (x1000) that no genuine mandate letter would present without segmentation, fund vehicle type, governance constraints, or deployment schedule.

- Large institutional capital allocators require KYC/AML, project due diligence, risk modeling, and staged tranches—not blind introductions via cold email.

3. Vague Role & Authority

- States: “I am solely responsible for investing a client's funds” — in institutional practice, discretionary authority is governed by mandates, investment committees, custodians, and compliance controls.

- No mention of fund type (family office, private equity, sovereign wealth, structured credit, mezzanine, infrastructure fund, etc.).

4. Geopolitical Narrative Manipulation

- A politically exposed person (PEP) angle (“embattled political background”) is used to justify capital relocation—classic laundering / sanctions-evasion pretext.

- Reference to GCC exit and multi-region diversification is broad, non-technical, and plausibly deniable.

5. Scattergun Target Market List

- Listing many jurisdictions (US, Canada, Europe, Brazil, Mexico, China, Japan, Bahamas, Indonesia) signals copy‑paste template — real allocators narrow focus by sector, geography, risk class, currency, and regulatory regime.

6. Overly Broad Sector Coverage

- Agriculture, mining, manufacturing, construction, real estate, trading, etc. — impossible for a single discretionary portfolio without internal specialization. Aimed at making any recipient think they “fit.”

7. Implausible ROI Threshold

- “At least 3% Annual ROI” is absurdly low for private direct project finance and contradicts the claimed sophistication of a multi-billion mandate. This attempts to appear conservative to reduce skepticism.

8. Absence of Standard Deal Artifacts

- No NDA reference, no teaser deck, no mandate letter, no RFP, no fund structure (LP/GP), no escrow instructions, no custodian name, no compliance contact.

9. Psychological Engineering

- Authority Illusion: Claims control over massive funds.

- Inclusivity Hook: “Capable private individual or firm globally” — extremely unscreened.

- Urgency by Ambiguity: Avoids timelines so prospect imagines scarcity/competition.

- Greed & Low Barrier: “Any viable project” + low ROI make engagement feel easy.

10. Likely Next Steps if You Respond

Scammers typically escalate with:

- Fake proof of funds (screenshots, banking letters, forged SWIFT docs)

- Request for project executive summary to harvest intel

- Introduction of intermediary “attorney / compliance officer”

- Demand for upfront fees: due diligence, retainer, “tax clearance”, anti-corruption certification, unlocking escrow, insurance bond, notarization

- Push for sensitive KYC docs (passport, corporate registrations) — identity theft risk

- Pressure to open a new “correspondent” or “escrow” account under their guidance

11. Potential Money Laundering Risk

- You may be groomed as an unwitting money mule / layering facilitator if you agree to “temporarily receive and forward” funds.

- Accepting unexplained inbound international transfers can trigger AML reporting obligations, account freezes, or legal exposure.

12. Linguistic & Structural Indicators

- Mixed capitalization (“Real estates”), awkward redundancy, and generic corporate phrasing without technical financial lexicon (no IRR, hurdle rate, risk banding, liquidity horizon, governance framework).

How This Scam Typically Progresses

| Phase | Tactic | Objective |

|---|---|---|

| 1. Hook | Flattering unsolicited mandate | Elicit reply / validate active inbox |

| 2. Credential Theater | Fake fund sheets, POF, LOI | Build perceived legitimacy |

| 3. Administrative Gate | “Compliance / clearance” forms | Justify fee request |

| 4. Fee Extraction | Due diligence / insurance / tax | Monetize victim repeatedly |

| 5. Escalation | Bigger tranches, urgency | Deepen sunk-cost commitment |

| 6. Termination | Silence or new alias | Exit after max extraction |

If you resist fee payment, they may pivot to: money laundering proposal, crypto wallet “liquidity bridging,” or sale of fake SBLC / BG instruments.

Recommended Actions

Immediate

- Do not respond.

- Mark as phishing / spam in your mail client (improves future filtering).

- Do not forward internally without a security warning context.

Verification (If Curious — Perform Passively Only)

- Passive WHOIS lookup of the domain

investmentbank.com(age, registrant, hosting). Newly registered or privacy-shielded = higher risk. - Search the exact subject line — often appears in scam reporting forums.

- Check if parts of the text appear online (string search) to confirm template reuse.

Do NOT Provide

- Passports, PAN, corporate certificates, bank comfort letters, solvency declarations.

- Upfront “retainer,” “escrow activation,” or “anti-terror compliance” payments.

- Consent to open joint accounts or crypto wallets under remote instruction.

If You Already Replied

- Cease further communication.

- Monitor for follow-up social engineering attempts (LinkedIn, WhatsApp, Telegram).

- Flag any unusual inbound transfer attempts to your bank’s fraud team.

Reporting (Optional)

- National cybercrime portal / CERT in your jurisdiction.

- Anti-fraud intelligence communities / ISACs if corporate environment.

Educational Notes

| Legitimate Investment Outreach | This Scam |

|---|---|

| Specific sector thesis | "Any viable project" |

| Regulated entity disclosure | None |

| Defined ticket size & tranche | US$10M–US$10B span |

| Professional signature & contacts | Generic name only |

| NDA / mandate before details | Immediate open solicitation |

| Clear ROI framework / risk band | Arbitrary 3% floor |

Defensive Checklist (Quick Scan)

| Indicator | Present |

|---|---|

| Generic salutation (Sir/Madam) | Yes |

| Massive capital claim | Yes |

| Politically exposed backstory | Yes |

| Vague sectors / geographies | Yes |

| Minimal ROI ask | Yes |

| No compliance identifiers | Yes |

| Seeks “collaboration” pre-due diligence | Yes |

Conclusion

This email is a high-level advance-fee / investment mandate scam framework engineered to capture ambitious entrepreneurs, SMEs, or intermediaries seeking large capital injections. Its persuasive levers: oversized capital capacity, extremely low performance threshold, geopolitical displacement story, and artificially simplified onboarding. Every structural element substitutes verifiability with narrative volume. Treat it as malicious social engineering and do not engage.

Principle: Legitimate large-capital introductions arrive through verifiable networks (licensed advisors, investment banks, fund managers) — not cold generic emails with inflated mandate ranges.

Stay vigilant; archive for training / awareness if useful.